by firespringInt | Oct 26, 2016 | News

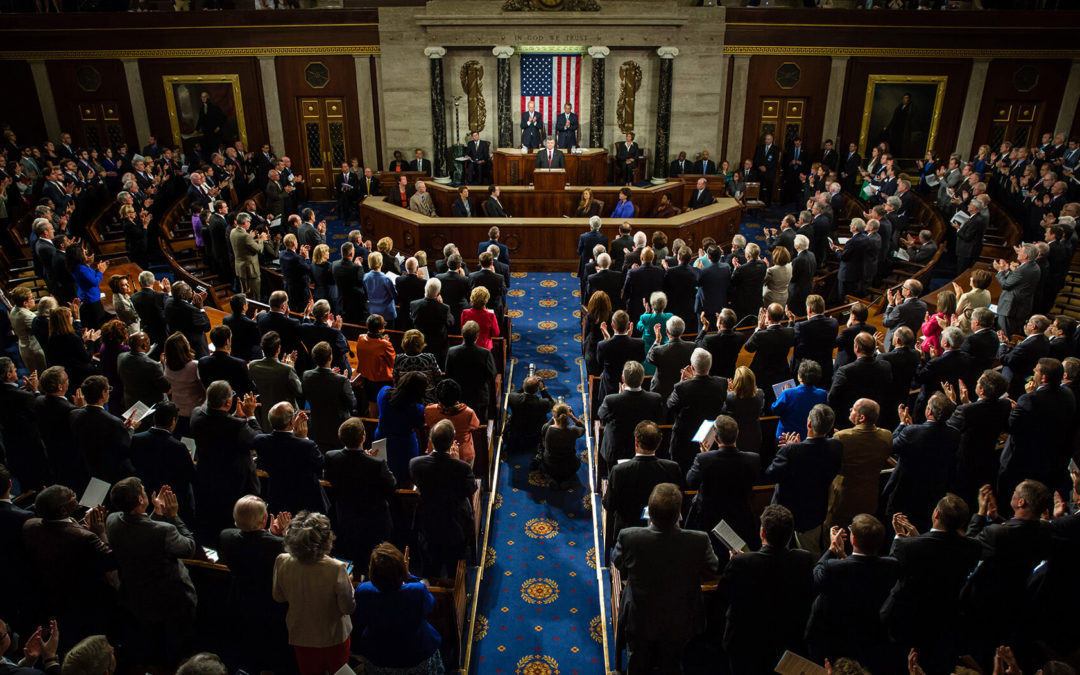

CONGRESS PASSES TARGETED TAX BILLS STOP-GAP SPENDING MEASURE CONGRESS PASSES TARGETED TAX BILLS STOP-GAP SPENDING MEASURE As lawmakers prepared to recess for November elections, they also passed several tax-related bills in September. The bills addressed IRS...

by firespringInt | Oct 26, 2016 | Planning

YEAR-END TAXPLANNING RIGHT AROUND THE CORNER YEAR-END TAX PLANNINGRIGHT AROUND THE CORNER It’s not too early to get ready for year-end tax planning. In fact, many strategies take time to set up in order to gain maximum benefit. Here are some preliminary considerations...

by firespringInt | Oct 26, 2016 | FAQs

FAQWHAT IS THE 80/50 RULE FOR VAN POOLING? FAQWHAT IS THE 80/50 RULE FOR VAN POOLING? Federal tax law allows taxpayers to exclude from income “qualified transportation fringe benefits.” Included in this category of benefits are van pools There are three types of van...

by firespringInt | Oct 26, 2016 | Tax Lien

HOW DO ISUBORDINATE A FEDERAL TAX LIEN? HOW DO ISUBORDINATE A FEDERAL TAX LIEN? A federal tax lien on real or personal property may be terminated or altered in many ways. The IRS must release a tax lien if the IRS determines that the tax liability has been paid or is...

by firespringInt | Oct 26, 2016 | Congress, Planning

YEAR-END TAXPLANNING MOVES FORWARD WITH OR WITHOUT CONGRESS YEAR-END TAX PLANNING MOVES FORWARDWITH OR WITHOUT CONGRESS In 2013, a new and unique tax will take effect—a 3.8 percent “unearned income Medicare contribution” tax as part of the structure in...